Understanding home equity

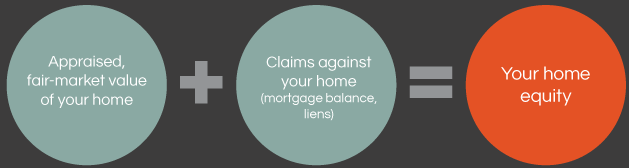

What is home equity? Think of home equity as an equation:

Notice how the equity you hold in your home changes based on changes in either of the variables:

- If the appraised value of your home increases, equity rises.

- If the appraised value of your home decreases, equity decreases.

- As you make more mortgage payments and reduce the principal mortgage balance, equity may rise, depending upon appraised market value

How do you use the equity in your home?

You may be able to use a portion of your home equity to pay for expected expenses, such as college tuition or home renovations, as well as for unexpected expenses, such as medical bills or extended periods of unemployment.

If you’re considering using the equity in your home, call us 866-612-5050, or email us to arrange a free consultation today. A Guarantee Loan Advisor experienced in helping homeowners put the equity in their homes to work will explain your options, which include:

- A home equity loan

- A home equity line of credit (HELOC)

- A cash-out refinance

For more information please visit our Disclosures page: https://apmortgage.com/disclosures